Ericsson and Nokia face R&D threat amid telco spending slump

Ericsson outspent Nokia in R&D last year for the first time since the Finnish vendor's Alcatel-Lucent takeover, but both companies are cutting back.

Cutting costs and jobs in difficult times is one of the most unpleasant tasks for any CEO. Besides the negative publicity and concern about the welfare of fellow humans (not all company bosses are heartless disciples of Ayn Rand), he or she must worry about knocking the proverbial legs out from under the business. For product vendors judged commercially on the competitiveness of their technologies, cuts to research-and-development (R&D) budgets can prove disastrous in the long run.

Ericsson faced criticism under former CEO Hans Vestberg in 2016 when it trimmed R&D spending by 9% or $310 million, at today's exchange rate, compared with the previous year. The shrinkage happened despite Ericsson's expansion into media and cloud markets under Vestberg, and all while Ericsson was being eclipsed in its European mobile heartlands by China's Huawei. A turnaround that began the following year under current CEO Börje Ekholm was based on exiting non-core activities and boosting R&D spend at the main networks business.

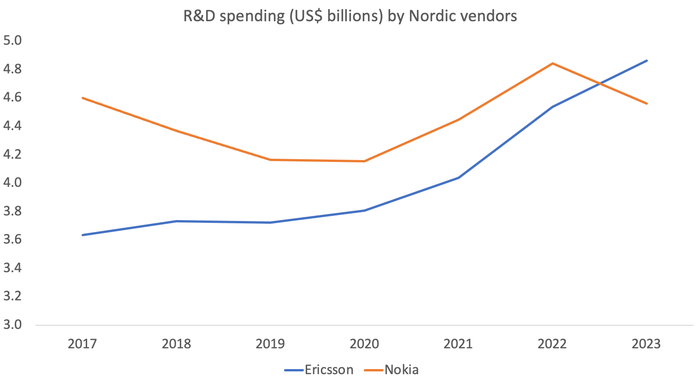

Finnish rival Nokia had its own negative experience when Rajeev Suri was in charge. After buying Alcatel-Lucent in a €15.6 billion (US$16.9 billion, at today's exchange rate) deal, Suri committed €4.2 billion ($4.6 billion) to R&D in 2017. But annual investments dropped by €400 million ($434 million) just two years later, when Nokia began disclosing details of product problems in 5G. Pekka Lundmark, who took over the CEO job in August 2020, has restored Nokia's reputation partly by pumping an extra €632 million ($685 million) into annual R&D expenditure between 2020 and 2022.

(Source: Ericsson, Nokia)

The big squeeze

Yet both Nordic vendors, hurt by the currently weak telco appetite for their network products, today face new R&D risks. Ekholm this week revealed that Ericsson has in the last year slashed "internal and external headcount" by roughly 9,000 jobs, and employee numbers recorded in its earnings statements were down from 105,529 in December 2022 to 99,952 a year later. He is not stopping there but will now "focus on taking costs out where appropriate," he told analysts on a call. Ericsson will have to "really pare back some of the investment areas we've had," he said.

It's the same story at Nokia, which plans to cut between 9,000 and 14,000 jobs by 2026, slashing between €800 million ($867 million) and €1.2 billion ($1.3 billion) off annual costs. Headcount had already dropped to about 86,000 at the time of the update in late 2023, from about 98,000 in 2019. If cuts are at the highest end of the planned range, the Finnish company will have reduced the size of its workforce by a staggering 26,000 people, more than a quarter of the former total, in just seven years.

This doesn't intrinsically mean R&D will suffer. "One of the main goals with that spending cut program is to protect R&D output," Lundmark said on a media call this week in response to a Light Reading question about the impact of cuts on investment areas. "There are a lot of possibilities to increase the productivity of R&D, for example with the help of new technologies like generative AI, and that's absolutely what we're going after."

Nevertheless, Nokia's advocates may be alarmed to see that R&D spending fell by 6% last year, around €259 million ($281 million), after two years of growth. The drop meant that Ericsson, with its narrower product focus on mobile networks, outspent Nokia for the first time since the Finnish vendor completed its takeover of Alcatel-Lucent. Back in 2017, the difference in spending levels was roughly $1 billion in Nokia's favor.

The problem for Lundmark is that Nokia's annual sales have also dropped by nearly €1 billion ($1.1 billion) over that period. As a percentage of revenues, it spent more on R&D last year than it did in 2017 (18.8% compared with 18.1%). And entirely ringfencing R&D from such hefty cuts may be impossible. A company awash in R&D resources is not much good if there is no one left to market and sell its products.

Swedish wobble

Ericsson, meanwhile, can hardly be accused of neglecting R&D in recent years. Besides divesting non-core assets, it spent $1.3 billion more last year than it did in 2017. Over the same period, Nokia's annual commitment is unchanged. Yet Ericsson is more diversified now than it was in the early years of Ekholm's reign, having spent $6.2 billion to acquire Vonage, a US software company, and another $1 billion on Cradlepoint, which develops mobile technologies for the enterprise sector.

What's more, R&D spending dipped by 200 million Swedish kronor ($19 million) year-over-year in the final quarter of 2023, to about SEK13 billion ($1.2 billion). Drawing attention to that in its latest financial report, Ericsson noted that "expenses decreased in Networks and Cloud Software and Services while they increased in Enterprise with continued investments in enterprise Wireless Solutions and Global Network Platform."

Such a minor wobble cannot be taken as a sign that heftier cuts lie ahead or that investment priorities have changed. On the networks side, those have previously included the development of cloud radio access network technology and application-specific integrated circuits (ASICs), Ericsson has flagged in previous financial reports. And both remain important to Ericsson, according to Fredrik Jejdling, who heads up the networks business.

"We don't see that we need to make any redistributions in terms of the investments we have," he told Light Reading. "Cloud is an important part of the deal we just took in the US," he added in reference to the $14 billion contract Ericsson signed with AT&T in December. The provision of purpose-built equipment featuring ASICs is also a part of that deal.

Even so, Ericsson, like Nokia, is under pressure. With sales down last year, R&D spending accounted for more than 19% of total sales, up from about 18% in 2021. This week it secured a €420 million ($455 million) loan from the European Investment Bank to help finance wireless R&D investments this year and next. That followed a €100 million ($108 million) "green funding" agreement with the Nordic Investment Bank signed in December. But given Ekholm's remarks on the latest earnings call about the need to "pare back" some activities, the days of spending growth may be over.

The big worry for both companies and their western backers remains Huawei. The Chinese rival's own annual investments in R&D soared by $10 billion between 2017 and 2022, to a whopping $22.6 billion that year, when they accounted for one quarter of Huawei's sales. Its exclusion from western markets and a US embargo on the sale of advanced technologies to China point to a possible fracturing of the mobile ecosystem along geopolitical fault lines. And that makes Ekholm very nervous, as he told Light Reading in 2021. "A Chinese ecosystem will be formidable competition for the west."

About the Author(s)

You May Also Like