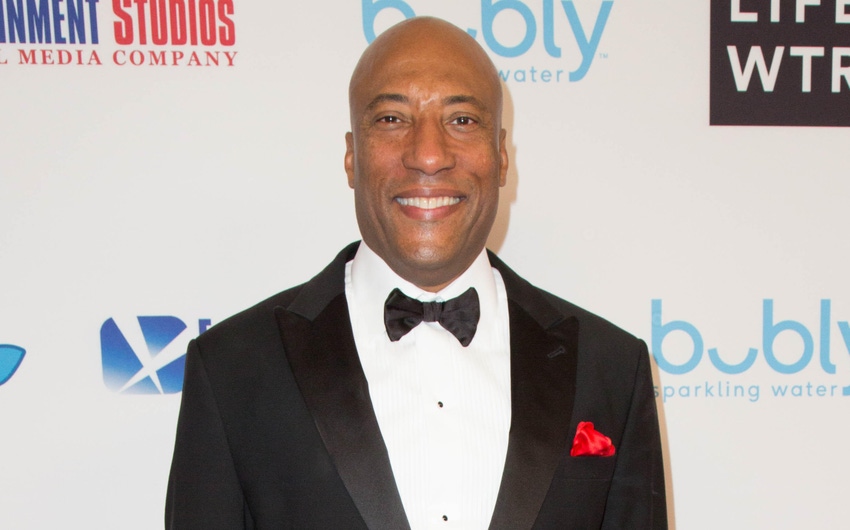

Byron Allen takes a run at Paramount

Allen Media Group, which owns The Weather Channel and several TV stations, made a $30 billion offer for Paramount Global. CEO Byron Allen reportedly wants to sell Paramount studio but retain its linear TV networks and Paramount+.

Byron Allen, the comedian-turned-media mogul who owns The Weather Channel and several US TV stations, has made a $14.3 billion bid for the outstanding shares of Paramount Global, the media giant that owns properties such as CBS, Paramount+ and the free, ad-supported Pluto TV streaming service. With existing debt factored in, the value of the deal climbs to roughly $30 billion.

Shares in Paramount Global popped $4.69 (24.45%) to $23.88 each in midday trading Wednesday.

"Mr. Byron Allen did submit a bid on behalf of Allen Media Group and its strategic partners to purchase all of Paramount Global's outstanding shares," Allen Media Group said in a statement. "We believe this $30 billion offer, which includes debt and equity, is the best solution for all of the Paramount Global shareholders, and the bid should be taken seriously and pursued."

Bloomberg, which first reported on the proposal, said Allen is offering $28.58 for the voting shares of Paramount and $21.53 for the non-voting shares.

The Wall Street Journal said this is Allen's second shot at Paramount, reporting that he made a larger, $18.5 billion bid last April.

His new plan, Bloomberg reported, is to sell the Paramount film studio and real estate, along with some other intellectual property, retain the company's TV channels and Paramount+ and "run them on a more cost-efficient basis." Allen took a run at Paramount-owned BET and VH1 channels last year.

Some industry watchers are skeptical about the offer.

"As of right now, the financing behind his bid is unclear, casting a shadow on the offer's credibility," MoffettNathanson analyst Robert Fishman said in a research note (registration required).

Allen Media Group hasn't elaborated on how it would finance its offer for Paramount, but Bloomberg said the company has investors lined up.

Paramount faces 'challenged fundamentals'

Fishman also believes Allen will be hard-pressed to run Paramount's linear TV networks and Paramount+ streaming service in a more efficient manner, noting that the company faces "increasingly challenged fundamentals."

Last week, Paramount Global CEO Bob Bakish warned employees of coming layoffs as it aims to "operate as a leaner meaner company and spend less" amid a broader plan to transition from linear networks to streaming – with an emphasis on making its streaming business profitable.

"As it has over the past few years, this does mean we will continue to reduce our workforce globally," the memo reportedly read. "These decisions are never easy, but are essential on our path to earnings growth."

The offer from Allen, who made a $10 billion play for Disney properties such as ABC, FX and National Geographic channels last fall, arrives amid rumors that other media companies, including Skydance Media, Apollo Group and Warner Bros. Discovery, have shown interest in combining with Paramount.

About the Author(s)

You May Also Like